This is a good time to present an update on Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) for a variety of reasons. One is that the stock has decisively begun a new bull market, as predicted in the original article posted on March 19. After this article was posted, the company came out with news on March 27 that a drill program is to be undertaken at its Tim property by Coeur Mining, with which it is working in collaboration. Here is an important and relevant paragraph from this news release.

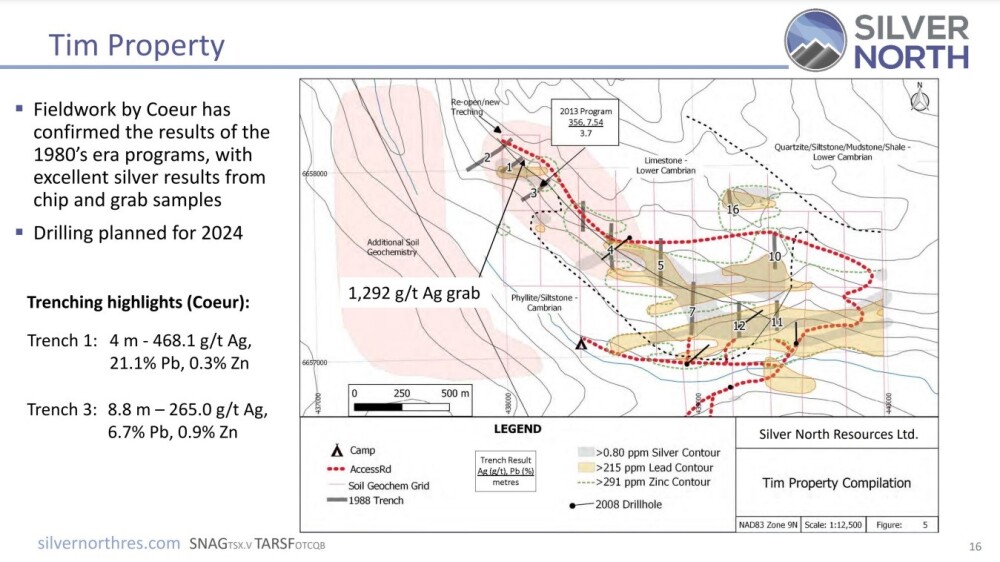

"Coeur is planning to commence the 2024 program in June, with the intention of completing drilling, geochemical sampling, and drill pad and access development, with crews operating out of the Silvertip mine camp. Approximately 2,000 meters of drilling is planned from up to six drill pads, testing the potential for CRD-style mineralization along almost 2,000 meters of strike length of prospective stratigraphy. Previous work has identified silver mineralization in trenches dating back to the 1980s. A 2022 program conducted by Coeur to verify previous trench sampling returned 468.1 grams per tonne of silver, 21.1% lead, and 0.3% zinc over four meters from one reopened trench. Another, located approximately 200 meters along the strike, returned 265 g/t silver, 6.7% lead, and 0.9% zinc over 8.8 meters. Silver North views Tim as a high-priority exploration target as it exhibits similar geological characteristics to Coeur's Silvertip Project."

Some details of the Tim Property are provided on the following slide.

Note that other slides from the company's investor deck, showing the Haldane property and more details of the Tim property, may be viewed in the original article.

On April 4, the company came out with the news that its earlier announced private placement was oversubscribed, so it was increased to CA$650,000. At about the same time, we saw a surge in the silver price, and the combined effect of the company's positive news and the rising silver price triggered the expected breakout by the stock to commence a new bull market. On the 11th, the private placement was announced closed, clearing the way for renewed advance by the stock soon.

Now, we will review the latest stock charts for Silver North.

On the 6-month chart, we can see how, over a week after the original article on the stock was posted, it broke decisively higher due to a combination of good news about the company and a strongly rising silver price, as mentioned above. After a steep ascent to briefly touch CA$0.195, it reacted back and then settled into a consolidation pattern, a bull Pennant, that we can confidently expect to lead to another upleg before long, with the marked dieback in volume a sign that a genuine Pennant pattern is forming.

This pattern should lead to another upleg of similar magnitude to the one leading into it, meaning that it will probably take it up to about 24 cents. Note that the Pennant boundaries drawn on the chart are provisional and may require adjusting later.

On the 2-year chart, we can see that the price is ascending out of the third low of a Triple Bottom, as expected, and it is useful as it shows us a reason why the next upleg is likely to take it to about 24 cents, where it should then pause because there is resistance in this area marking the upper boundary of the entire base pattern.

After pausing in this area, we can expect it to break above this resistance as silver itself continues to forge ahead, and it may very possibly be a result of the Coeur drilling program returning positive results.

Long-term charts for the stock may be viewed in the original article posted on March 19.

We, therefore, stay long, and Silver North is rated an Immediate Strong Buy for another upleg soon that will result in significant percentage gains from the current price.

Silver North's website.

Silver North Resources Ltd. (SNAG:CVE;TARSF:OTCMKTS) closed for trading at US$0.11, CA$0.16 on April 16, 2024

Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.